The current income accumulated from December 2023 a total of 10,464 million balbos, reflecting 1,363.2 million balbos compared to the previous year, but with a shortfall of 252.4 million balbos compared to what was budgeted for this period, according to data released by General Administration of Revenue (DGI).

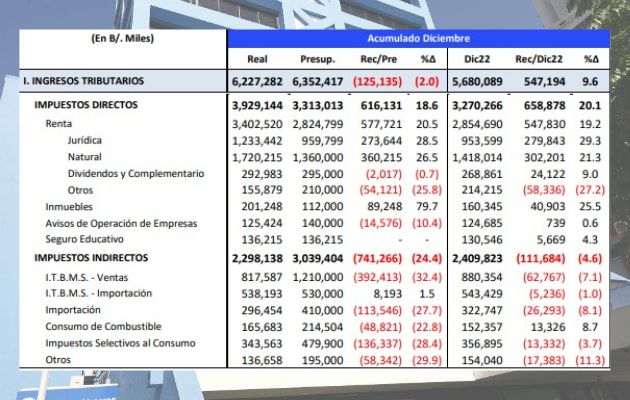

The tax revenue accumulated as of December 2023 were 6,227.3 million balbos, reflecting a shortfall of 125.1 million balbos compared to the budget.

Compared to the previous year, tax revenues increased by 547.2 million balbos. Tax revenues represent 60% of total current revenues, according to DGI.

In the meantime, direct taxes show a surplus of 18.6% compared to the planned. Compared to the same period last year, they recorded an increase of 658.9 million balbos.

According to behavior indirect taxes, They resulted in a deficit of 24.4% compared to the legal budget. In this way, indirect taxes accumulated around 2,298.1 million balboas in December 2023, against 3,039.4 million balboas, with a deficit of 24.4%.

in indirect taxes They highlight the budget deficit of 24.4% ITBMS – Sales, 32.4% ITBMS – Imports, likewise, import taxes reflect a deficit of 27.7%, fuel consumption with 22.8%, and selective consumption tax with 28, 4%.

The collections in Share of profits and contributions, pFor the month of December, they accounted for 96% of the total non-tax income.

As for what is expected in the statutory budget accumulated through December, Other current income They resulted in a deficit of 72.3%. Likewise, they show a decrease of 37.5% less compared to

last year.

Taxes that recorded higher growth in 2023 compared to 2022

Payments with tax documents represented a total of 32.2 million dollars in the month of December 2023, where the most relevant figure corresponds to the item Consumption of gasoline with 17.7 million balbos.

Among the direct taxes that increased the most in 2023, the tax on legal entities stands out, which increased by 33.7%, from 884.3 million balbos in 2022 to 1,182.6 million balbos. Likewise, the property tax increased by 25.5%, from 160.3 million balbos in 2022 to 201.2 million.

Likewise, the payroll tax increased by 23.9%, registering 1,268.4 million balbos in 2022 and then a total of 1,571.1 million balbos in 2023.

Another one that showed an increase in 2023 is the dividend tax which increased by 16.9%, rising from 162 million balbos in 2022 to 189.4 million balbos.

On the other hand, from indirect taxes, those that showed the greatest growth are: ISC – Imported cigarettes, which increased by 71.9%, from 18.1 mil. from balbo in 2022 to 31.2 million balbos, ISC – Automobiles with 17.7%, which collected 140.1 million balbos in 2022 and reached 165.0 million balbos by 2023 and Fuel consumption with a growth of 8.7% , going from 152.4 million balbos in 2022 to 165.7 million balbos.

Source: Panama America

I am Jason Root, author with 24 Instant News. I specialize in the Economy section, and have been writing for this sector for the past three years. My work focuses on the latest economic developments around the world and how these developments impact businesses and people’s lives. I also write about current trends in economics, business strategies and investments.